Original Medicare

Introduction Section

Turning 65? Understanding Original Medicare is the foundation of your Medicare journey. Before you can build your Medicare Umbrella, which is what we call our Protection Package, you need to know what Original Medicare covers—and more importantly, what it doesn’t.

What Is Original Medicare?

Original Medicare is the federal health insurance program for people:

Age 65 or older – Main group who qualify for Medicare

Under 65 with a qualifying disability – After receiving SSDI benefits for 24 months

ESRD (End-Stage Renal Disease) – Permanent kidney failure needing dialysis or transplant, qualifies regardless of age

ALS (Lou Gehrig’s disease) – Qualifies for Medicare at any age when disability benefits start

Must be U.S. citizen or permanent resident – Typically 5 years for legal residents

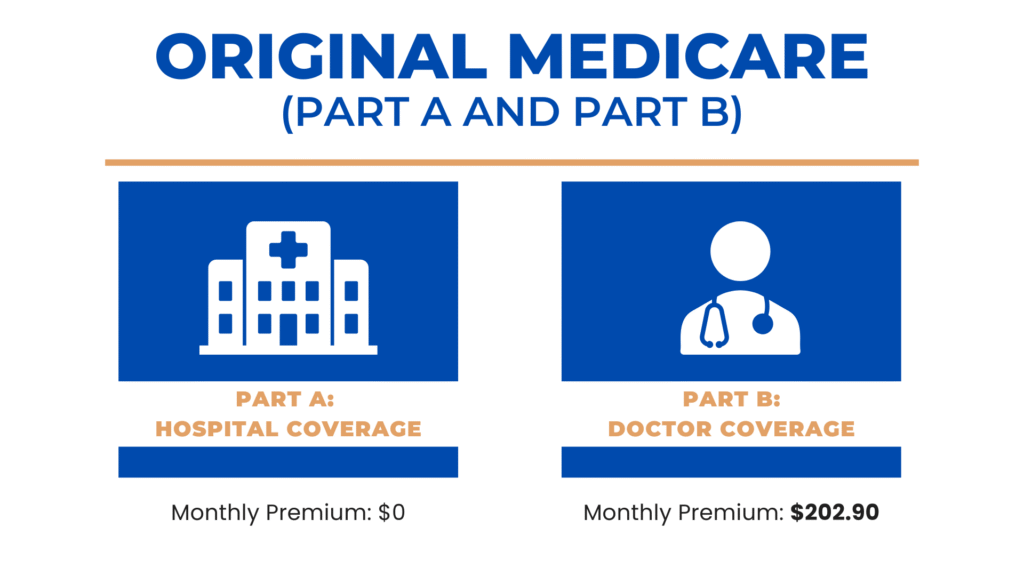

It consists of two parts:

Part A: Hospital Coverage

- Inpatient hospital stays

- Skilled nursing facility care (with conditions)

- Hospice care

- Some home health care

Monthly Premium: $0 for most people (if you or your spouse paid Medicare taxes for at least 10 years)

Part B: Medical Coverage

- Doctor visits and outpatient care

- Preventive services

- Ambulance services

- Durable medical equipment

- Lab tests and X-rays

Monthly Premium: $202.90 in 2026 (standard premium; higher-income earners pay more)

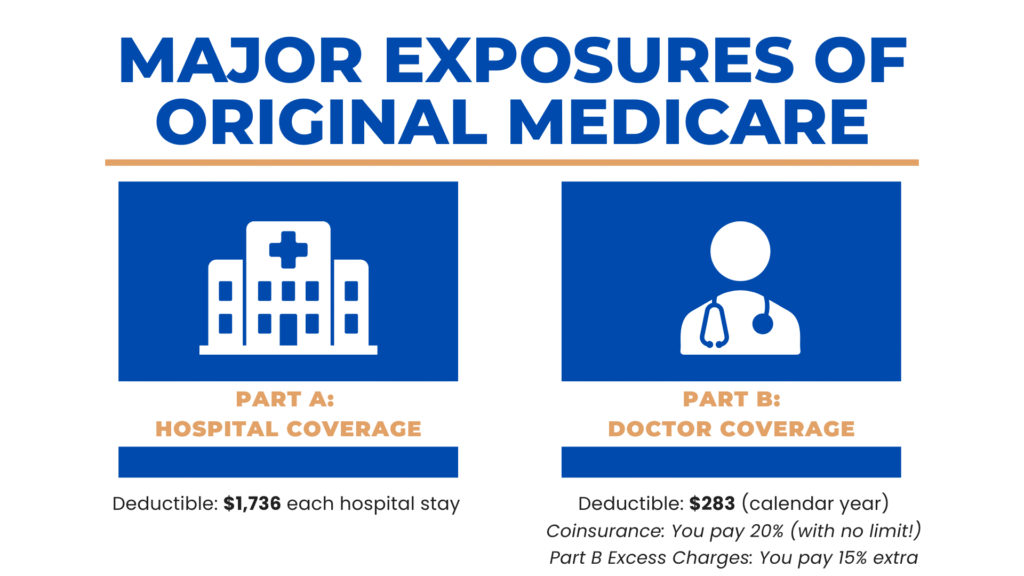

The Major Exposures of Original Medicare

Original Medicare leaves you financially exposed to significant out-of-pocket costs. These are the gaps that can cost you thousands if you’re not prepared:

Hospital Stay Costs – Part A

Deductible: $1,736 per benefit period

- You pay this each time you’re admitted to the hospital

- You can face this multiple times per year

Days 61-90: $434 per day coinsurance

Days 91+: $868 per day (lifetime reserve days)

After 150 days: You pay 100% of costs

Skilled Nursing Facility Costs – Part A

Important: You must have a 3-day minimum inpatient hospital stay to qualify for skilled nursing coverage.

Medical and Outpatient Costs – Part B

Annual Deductible: $283 (calendar year 2026)

Coinsurance: 20% of Medicare-approved amounts with NO LIMIT

- A $50,000 medical bill means you pay $10,000

- A $100,000 medical bill means you pay $20,000

- There is no maximum out-of-pocket protection

Part B Excess Charges: Up to 15% above Medicare-approved amounts (if your doctor doesn’t accept Medicare assignment)

What Original Medicare Does NOT Cover

- Prescription drugs

- Dental care

- Vision care

- Hearing aids

Critical Illness Exposure

Cancer, Heart Attack, and Stroke

Medicare covers medically necessary treatment, but you will have out-of-pocket expenses that Medicare does not cover:

- Expensive drugs (you’ll hit the $2,100 Part D limit fast)

- Experimental treatments

- Travel and lodging

- Non-covered medications

- Income replacement

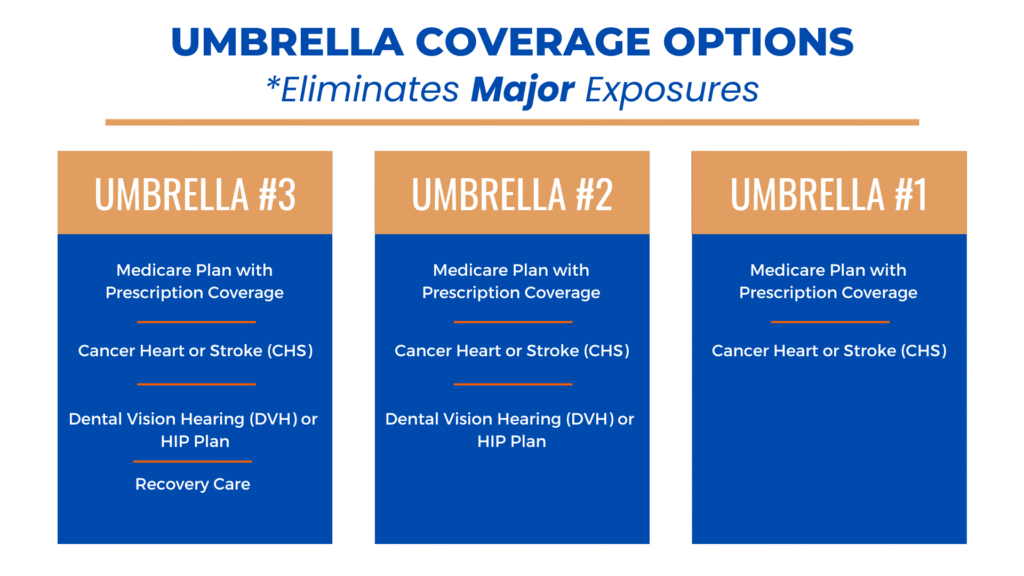

We always recommend Cancer or Heart Attack/Stroke coverage for every Medicare beneficiary through one of the Umbrella packages:

It will consist of a Medicare plan option with Part D to cover the Medicare-approved expenses. For the non-Medicare-approved expenses we add a Cancer Heart Attack or Stroke plan, a Hospital Indemnity, Dental Vision & Hearing, and a Recovery Care, tailored to fit your lifestyle and budget.

In California, most of these protection packages must be purchased before you turn 65.

Next Steps: Close the Gaps

Now that you understand the major exposures of Original Medicare, it’s important to add layers of protection on top of this to cover the gaps as much as possible. We start by choosing one of two plan options:

Option 1: Medicare Supplement + Part D

Option 2: Medicare Advantage

Go to the Medicare Supplement and the Medicare Advantage sections to learn more in depth, download the Medicare Explained Ebook.

Get The Medicare Explained EbookReady to schedule your personalized Medicare consultation?

Schedule A 1-On-1 Call