Dental & Vision

Why is Dental Coverage important?

Maintaining a good oral hygiene plays a big factor on your body’s overall health. You do your part by brushing and flossing 2 to 3 times a day but it is still important to have regular checkups with your dentist to make sure your teeth and gums are healthy.

On the contrary, you risk having cavities and gum disease, which can then lead to some other health issues, such as cardiovascular disease and pneumonia.

Visiting your dentist regularly can also help detect early signs of an illness.

Did you know about 33.6% of adults between the ages of 19-64 have dental benefits and about 12% of seniors over age 65 have some sort of dental insurance but only half have visited a dentist the previous year?

The number of American seniors over the age 65 is projected to double in the next few years.

What are my options?

I’ve once heard a dentist recommend you save some money aside for when it’s time to get some dental work done.

You can also purchase a stand-alone dental insurance plan, which usually comes in two types: an HMO and a PPO.

HMO Dental Plans. You’ll have to choose a dental provider that is part of the network and typically there will be a schedule of fees which will show you what dental benefits are covered, what the copays are for those benefit and any restrictions and exclusions there may be.

PPO Dental Plans. There is still a network of dentists, which will give you the best rates for the services you need but this type of plan also allows you to visit dentists who are out-of-network by paying a higher percentage.

Dental Discount Plans. Not considered insurance. The benefits of these plans are that they are affordable, there’s no annual limit and no paperwork to deal with.

It’s as simple as going to a participating provider, showing your discount card and paying the discounted rates and you’re set.

What if I have Medicare? Doesn’t Medicare cover dental?

Unfortunately, Medicare does not cover routine dental.

If you are on a Medicare Advantage plan, they may have a dental plan included as an added benefit, or they may offer it as an optional supplemental benefit, where you would pay a monthly premium.

If you aren’t sure your plan covers dental, you should take a look at the Summary of Benefits, or Evidence of Coverage from your plan, or call your plan’s member services line to find out.

Now that you know what options are available to you, it’s time to shop for a dental plan that fits your budget. Click on any of the carriers below to explore the benefits and enroll.

Feel free to reach out if you have any questions.

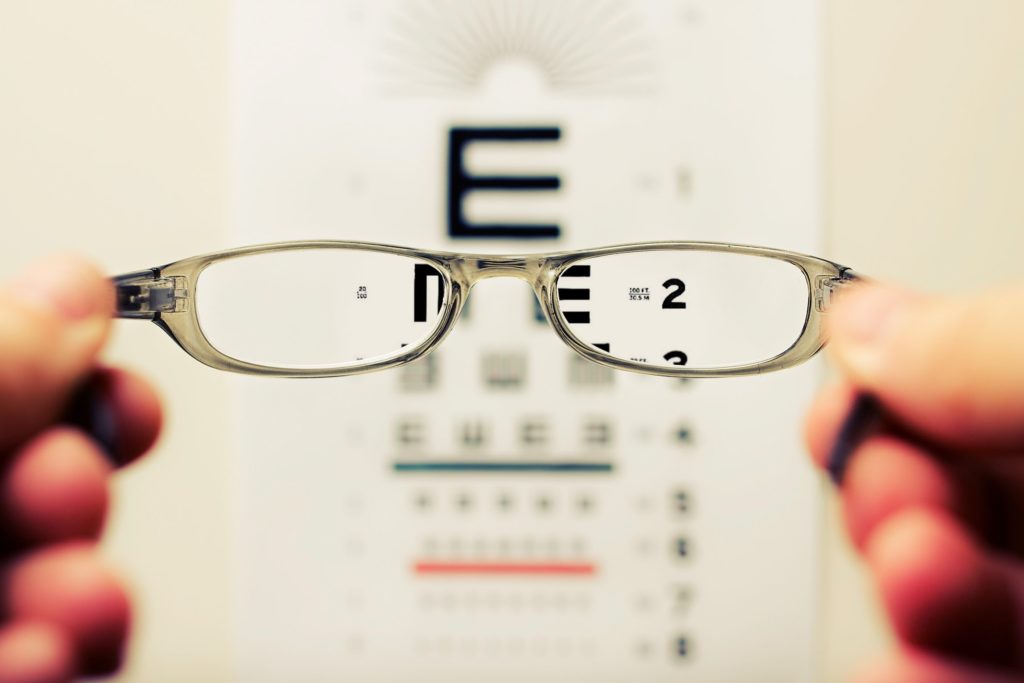

Vision Benefits

Very often we find out our existing health insurance doesn’t cover routine vision benefits, such as eye exams and glasses. If you’re an adult on Covered California, your plan does not include routine eye care. If you’re a Medicare beneficiary, you’ll realize Medicare does not cover routine vision benefits either.

People with poor vision or inadequate eyewear face problems such as frequent headaches, poor self-care, accidents especially falls.

If you’re a senior on Medicare plan such as a Medicare Advantage, check with your plan to see if they cover routine vision, or if they offer an optional supplemental benefit where you pay a premium for the added benefit. Sometimes it can be bundled with other benefits such as dental.

Another option would be to use a Vision Discount Card or purchase a Vision Insurance plan.

Careington offers a package that includes discounts for dental, vision and telehealth benefits.

Ameritas offers two vision insurance plans that you can choose from, between EyeMed and VSP. You can also bundle adding a dental insurance plan.

Direct Vision offers a few options that include Lasik discounts.

*Contact me if you have any questions or need assistance.