Medicare Supplement (Medigap)

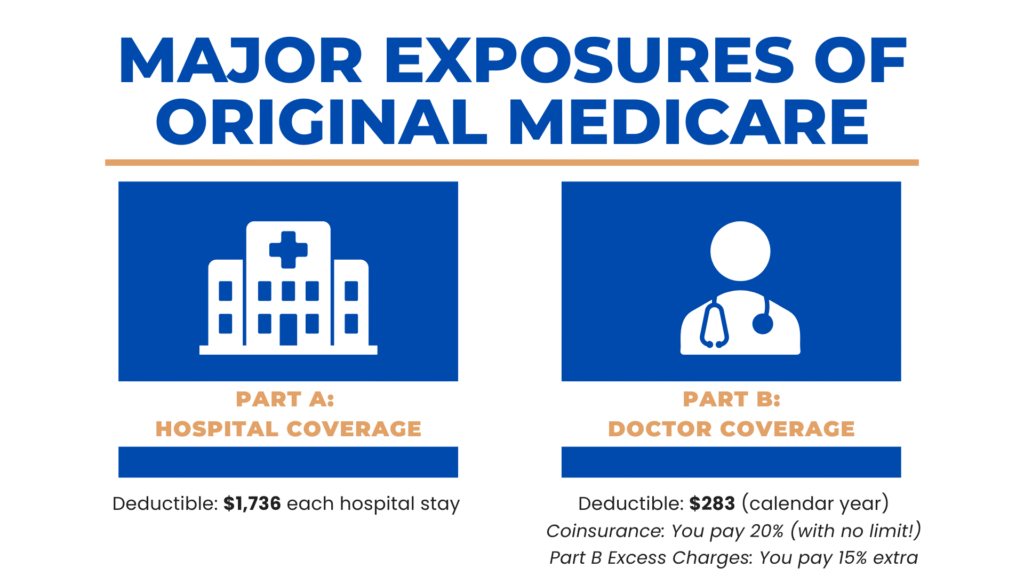

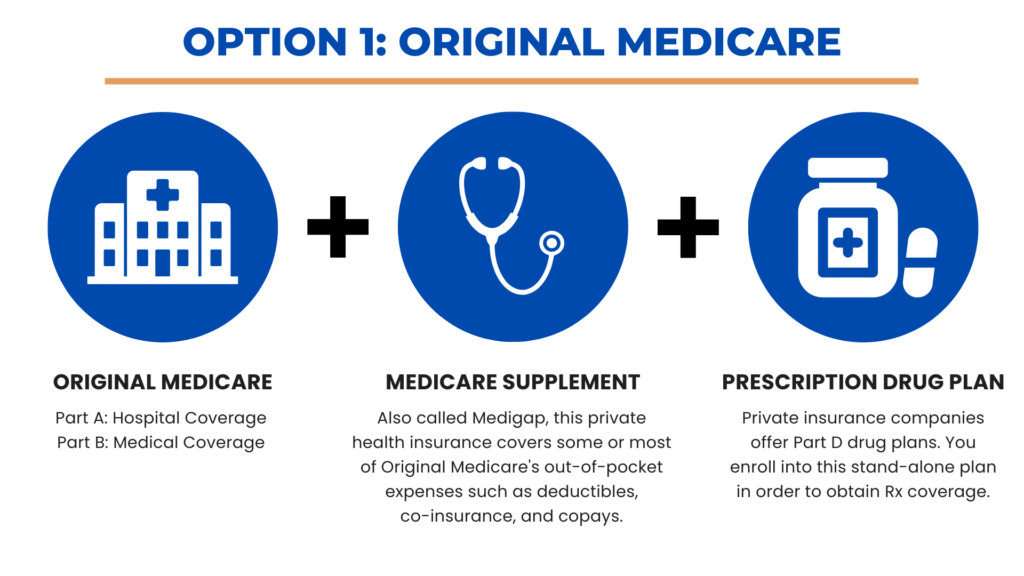

Medicare Supplement insurance, also called Medigap, helps cover the major financial exposures that Original Medicare leaves open—deductibles, coinsurance, and copayments.

If you choose a Medicare Supplement plan, you’ll pair it with a standalone Part D prescription drug plan to close the gaps in Original Medicare.

What Is Medicare Supplement?

A Medicare Supplement policy works alongside Original Medicare Parts A and B. When you receive covered healthcare services:

- Medicare pays first – Medicare pays its share of the Medicare-approved amount

- Your Supplement pays second – Your Medigap policy pays its share

- You pay very little – You have predictable, low out-of-pocket costs

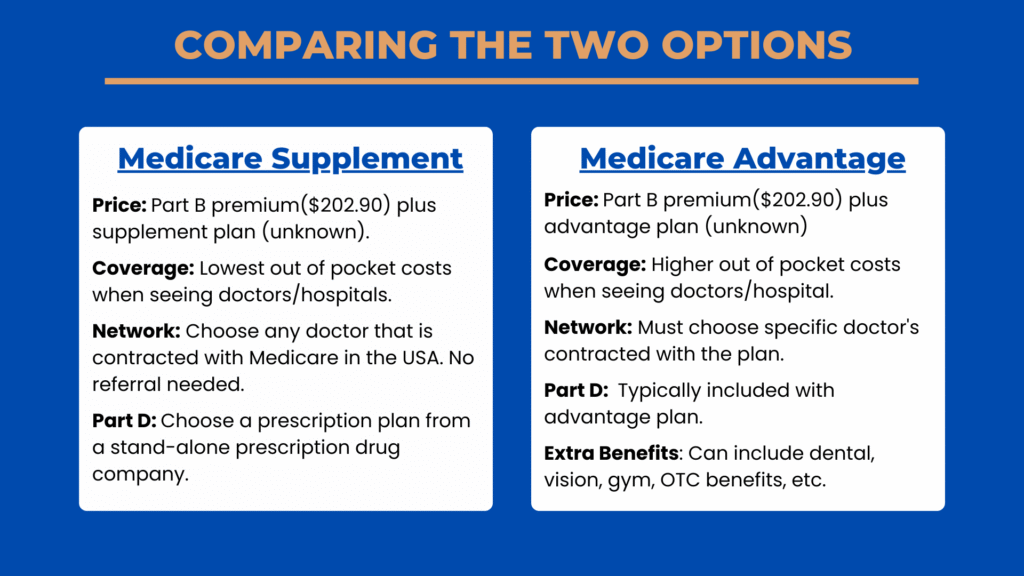

Key Benefit: Medicare Supplement plans offer the lowest out-of-pocket costs and the freedom to see any doctor in the United States that accepts Medicare—no networks, no referrals needed.

The Two Most Popular Plans: Plan G and Plan N

Medicare Supplement plans are standardized by the federal government. This means Plan G from Company A offers the exact same coverage as Plan G from Company B. The only difference is the premium.

Plan G – Most Comprehensive

What you pay:

- Medicare Part B deductible: $283 (calendar year 2026)

- After that: $0 for covered services

Monthly Premium: $120-$160 on average for someone turning 65 (varies by zip code and insurance company)

Best for:

- People who want the most predictable costs

- Those who see doctors frequently

- Anyone who wants maximum coverage

- Freedom to see any provider that accepts Medicare assignment; no network

Plan N – Lower Premium Option

What you pay:

- Medicare Part B deductible: $283 (calendar year 2026)

- $20 copay per doctor visit

- $50 copay per ER visit (waived if admitted)

- Possible Part B Excess Charges (up to 15%)

- Everything else similar to Plan G

Monthly Premium: Typically lower than Plan G but all depends on zip code.

Best for:

- People in good health who don’t visit doctors often

- Those who want to save on monthly premiums

- Those that still want freedom to see any doctor

You Must Pair Your Supplement with Part D

Medicare Supplements do not include prescription drug coverage. You’ll need to enroll in a standalone Medicare Part D plan to cover your medications.

We help you:

- Input your drug list into Medicare’s calculator

- Choose your preferred pharmacy

- Compare all Part D plans in your zip code

- Enroll in the plan with the lowest total cost for YOUR medications

Best Time to Enroll: Your Medicare Supplement Open Enrollment Period

Six months before your 65th birthday month is the ideal time to enroll.

During this window:

- Guaranteed acceptance – Insurance companies cannot deny you or charge more due to health conditions

- Lowest rates – You’ll lock in the best pricing

- No medical underwriting – No health questions asked

After this period, you may face:

- Medical underwriting (health questions)

- Higher premiums based on health

- Possible denial of coverage

Don’t wait—enroll during your 6-month window to get the best rates and avoid issues.

Schedule A CallMedicare Supplement vs. Medicare Advantage

Not sure which coverage path is right for you?

Medicare Supplement (with Part D) and Medicare Advantage are the two main ways to close the gaps

in Original Medicare. Each has pros and cons depending on your situation.

Ready to Explore Medicare Supplement Plans?

We’ll help you compare Plan G and Plan N options from multiple carriers in your area, find the best rates, and build your complete Medicare Umbrella.

Get started:

For more indepth information on your Medicare options and how to cover these exposures, download the Medicare Explained ebook.

The Medicare Explained EbookQuestions? We’re here to help.

Call us at (951)404-0642 or schedule a free consultation to discuss your Medicare Supplement options.

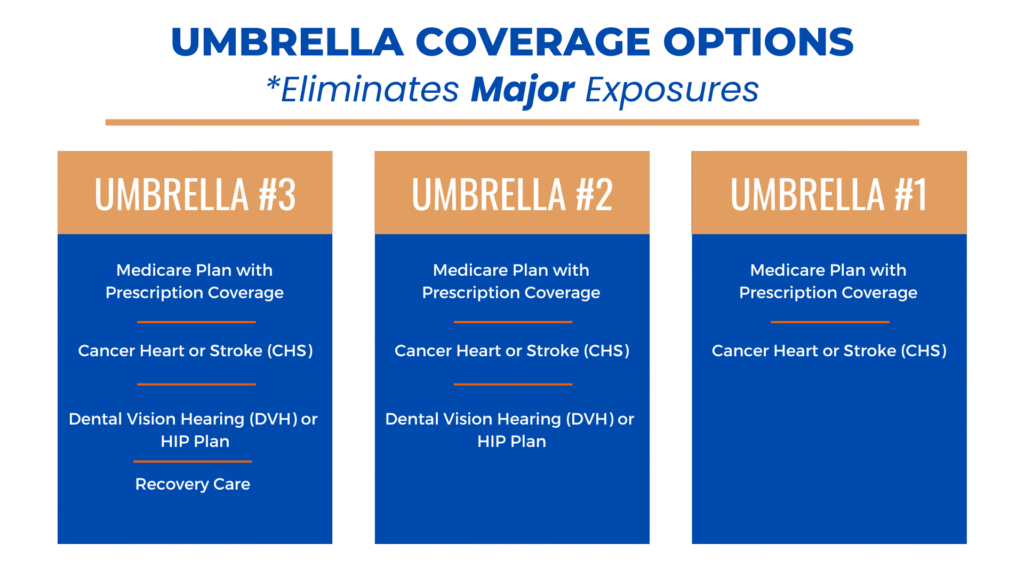

Schedule A CallComplete Your Medicare Umbrella Protection

A Medicare Supplement paired with Part D is just the foundation that covers Medicare-approved expenses. We always recommend an umbrella to protect you against the non-Medicare-approved expenses.

Your Complete Medicare Umbrella Includes:

Foundation Layer:

Original Medicare is the foundation and will build on that to create a more comprehensive coverage.

- Medicare Supplement (Plan G or Plan N)

- To cover the Medicare-approved expenses

- Part D

- To cover your Prescription Drugs

Protection Layer:

- Cancer, Heart Attack & Stroke Coverage – We recommend this for every Medicare beneficiary. Medicare doesn’t cover all expenses from a critical illness diagnosis:

- expensive drugs (you’ll hit the $2,100 Part D limit fast),

- experimental treatments

- travel

- lodging,

- income replacement

Other Coverage To Layer:

- Dental, Vision & Hearing – Original Medicare doesn’t cover routine care

- Hospital Indemnity – Cash benefits to cover deductibles and non-medical expenses

Why Build an Umbrella?

Your Medicare Supplement closes the gaps in Parts A and B. But it doesn’t protect you from:

- Expensive cancer treatments and related costs

- Heart attack or stroke recovery expenses

- Prescription drug costs above your Part D plan

- Dental, vision, and hearing needs

- Hospital stays and recovery care expenses

An Umbrella Package eliminates these major exposures and gives you true peace of mind.

Important: Most protection plans in California can only be purchased before you turn 65.

Don’t wait! Schedule a call so we can build an Umbrella tailored to your lifestyle and budget.

Ready to schedule a no-cost 1-on-1 consultation? Click on the button below.

Schedule A Call