Medicare Part D: Prescription Drugs

Understanding Part D Prescription Drug Plans

Introduction: Part D Prescription Drug Plans are an essential component of Medicare coverage, providing access to prescription medications and helping individuals manage their healthcare costs. Here, we’ll explore the key aspects of Part D plans and how they work to ensure you have the information you need to make informed decisions.

- What is Part D?

- It’s a voluntary prescription drug benefit program offered to people eligible for Medicare.

- It was introduced by the government in 2006 to help pay for prescription drugs

- It’s provided by private insurance companies approved by Medicare

- Medicare Part D plans are offered by private insurance companies approved by Medicare.

- Part D plans have costs such as premiums, deductibles, copayments and coinsurance which vary depending on the plan

- Each plan has its own formulary, which is a list of covered drugs

- Beneficiaries can choose a Part D plan that best suits their prescription drug needs

- There are also programs available to help low-income beneficiaries with their Part D costs.

- Coverage and Cost:

- Drug Formularies: Each Part D plan has their own list of covered drugs, known as a formulary. The formulary will indicate the drug tier, if a drug requires a step therapy, prior authorization or have quantity limits.

- Cost-sharing: Part D plans come in 2 forms: standalone or included in a Medicare Advantage Prescription Drug plan (MAPD). Standalone Part D plans will have a premium, may include a yearly deductible, copayments, and coinsurance per covered drug.

- Part D Coverage Phases:

- Deductible: you pay the negotiated rate for your prescription drugs until you meet an amount.

- Initial Coverage: after meeting the deductible, you will pay a copayment or coinsurance for your covered drugs stated in the Part D plan’s Summary of Benefit. In 2023, the Initial Coverage Limit is $4660, and what is counted is what you pay and what the plan pays towards your covered drugs.

- Gap or Donut Hole: After reaching the Initial Coverage Limit, you will then pay 25% of your covered drugs. For generic drugs, the Part D carrier covers 75% of the cost. For brand drugs, the pharmaceutical companies pay 70% and the Part D carrier pays 5%.

- Catastrophic Coverage: You enter this stage after your True-Out-of-Pocket-Maximum (TRoOP) reaches $7400. What counts is what you or anyone pays on your behalf, including the pharmaceutical companies, for your covered prescription drugs. What is excluded is what the Part D carrier pays and other plans such as VA benefits, TriCare for Life or Government-Funded Programs. In this stage, you will pay 5% or $4.15 for generics and $10.35 for brands. You will remain in this stage until December 31, 2023.

- Choosing a Part D Plan:

- Plan Comparison: When shopping for Part D coverage, it is important to shop and compare plans as your total costs may be vary significantly from one plan to another. Most plans will have a network of pharmacies which may offer a preferred rate versus a standard rate for non-network pharmacies.

- Check if there are any requirements for your covered drugs and the steps you must take in to properly dispense them.

- You can use Medicare.gov to shop and compare. You’ll be able to look up your medications to see monthly and yearly costs, what months you’ll move to the next stage, etc. You can then select the Part D plan that meets your individual needs.

- Extra Help (Low-Income Subsidy):

- This program that provides financial assistance to individuals with limited income and resources to help pay for Part D coverage, such as premiums, deductibles and copayments/coinsurance.

- To qualify, an individual’s monthly income must be no more than $1843 and $2485 for a couple.

- You can apply at your local Social Security Administration office or apply online at ssa.gov. It usually takes at least 2 weeks to receive a notice of approval or denial.

Enrollment Periods

Initial Enrollment Period (IEP): starts 3 months before your 65th birth month and ends 3 months after, for a total of 7 months.

Annual Enrollment Period (AEP): October 15- December 7. During this period you will be able to make changes to your Part D coverage.

Special Enrollment Period (SEP): you’ll be able to make a change to your Part D coverage if you qualify. Some instances would be if you moved to a new service area, you lost other creditable coverage or you have low income subsidy. Generally you’ll have 60 days to make a change, but this can vary depending on the SEP.

Late Enrollment Penalty

After your Initial Enrollment Period, if you go more than a 63-day period in a row without Part D or other creditable coverage, you may have to pay a late enrollment penalty. The Late Enrollment Penalty is added onto the Part D monthly premium permanently, or for as long as you have Part D. The Late Enrollment Penalty is calculated by multiplying the amount of months you went without creditable coverage by 1% of the national base Part D premium ($32.74 in 2023).

Some individuals may be exempt from having a late enrollment penalty if they have creditable coverage, which is coverage just as good as Medicare’s Part D coverage. An example would be a working individual that is covered through their employer’s group insurance and is considered to have creditable coverage.

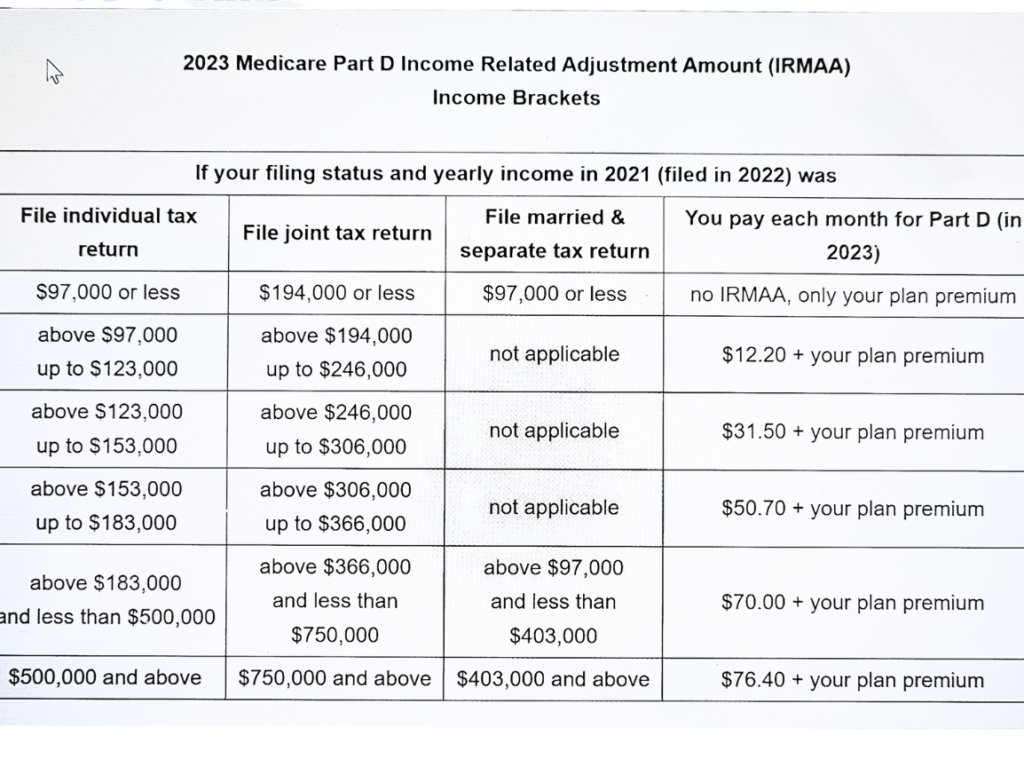

Part D Income-Related Monthly Adjustment Amount (IRMAA)

For individuals whose income in 2021 was over $97,000 or $194,000 for a couple may have to pay a surcharge in addition to their Part B and Part D premium.

For more information on Part D, visit Medicare.gov.

If you have questions or need assistance, schedule a call with me.