Covered California & Affordable Choice: Build Your Health Insurance Umbrella

We help you combine Covered California, Affordable Choice, and supplemental plans to build a personalized health insurance Umbrella that protects you from high out‑of‑pocket costs.

Not turning 65 yet? Whether you’re under 65, transitioning from employer coverage, losing coverage when your spouse enrolls in Medicare, or your young adult is aging off your plan—you need health coverage that protects you from high costs.

Even the best Covered California plans leave significant gaps and high out-of-pocket expenses. We help you build comprehensive protection at an affordable price.

Who Needs Individual/Family Health Coverage?

You may need Covered California or individual health insurance if you’re in one of these common situations:

Turning 65 with a Younger Spouse

- One spouse qualifies for Medicare at 65, but the other isn’t there yet

- When you retire and lose employer group coverage, your under-65 spouse needs their own plan

- We coordinate Medicare for you and Covered California for your spouse—one point of contact for both

Young Adults Aging Off Parents’ Plan (Turning 26)

- Once you turn 26, you can no longer stay on your parents’ health insurance

- You need your own Covered California plan, even if you’re healthy

- We help you find affordable coverage and check if you qualify for subsidies

- Important: Don’t wait until your 26th birthday—enroll during your Special Enrollment Period to avoid gaps

Losing Employer Group Insurance

- Retiring before age 65

- Laid off or job transition

- Employer no longer offering coverage

- Moving from full-time to part-time status

- COBRA is too expensive (often 3-4x more than Covered California with subsidies)

Self-Employed or Small Business Owners

- No access to group coverage through an employer

- Need affordable individual or family plans with subsidy eligibility

Early Retirement (Before Medicare Eligibility)

- Retired at 60-64 and need coverage until Medicare starts at 65

- Bridge coverage between employer insurance and Medicare

- Critical years when health issues often arise

Young Families & Working Adults

- Need comprehensive health coverage for yourself and dependents

- Children who need pediatric coverage

- Parents looking for family plans that cover everyone

Special Situation #1: One Spouse on Medicare, One on Covered California

This is one of our most common scenarios for couples.

When one spouse turns 65 and enrolls in Medicare, the under-65 spouse typically loses access to employer group coverage and needs their own plan.

Here’s how we help:

For the 65+ Spouse (Medicare):

- Enroll in Medicare Parts A & B

- Choose Medicare Supplement or Medicare Advantage

- Add Part D prescription drug coverage

- Build complete Medicare Umbrella package to cover the major exposures in Original Medicare. Download the Medicare Explained Ebook for a more indepth information.

For the Under-65 Spouse (Covered California):

- Find the best Covered California plan based on their doctors and medications

- Check subsidy eligibility based on household income

- Add Cancer/Heart/Stroke or Affordable Choice coverage to reduce out-of-pocket costs

- Ensure comprehensive protection until they reach Medicare age

We Coordinate Both:

- One point of contact for both Medicare and Covered California

- We ensure nothing falls through the cracks during this transition

- Year-round support for both plans

Special Situation #2: Turning 26 and Coming Off Parents’ Insurance

Your 26th birthday triggers a Special Enrollment Period.

Federal law allows you to stay on your parents’ health insurance until age 26. Once you turn 26, you must get your own coverage.

What you need to know:

Timing Matters:

- Your coverage under your parents’ plan ends on your 26th birthday OR at the end of the month you turn 26 (depends on the plan)

- You have a 60-day Special Enrollment Period to enroll in your own Covered California plan

- Don’t wait—enroll as soon as possible to avoid gaps in coverage

Affordable Options for Young Adults:

- Many young adults qualify for subsidies that make Covered California plans affordable

- Bronze plans with low premiums may work if you’re healthy

- Consider a higher-tier plan if you have regular medical needs or prescriptions

We Help You:

- Determine your subsidy eligibility based on your income

- Compare plan options that fit your budget

- Enroll you quickly to avoid coverage gaps

- Add optional Cancer/Heart/Stroke coverage (smart for young families starting out)

Parents: If you’re helping your young adult child transition to their own plan, we make it easy. One call handles everything.

Turning 26 soon or helping your child get coverage?

Schedule Your 1-On-1 ConsultationThe Challenge with ACA/Covered California Plans

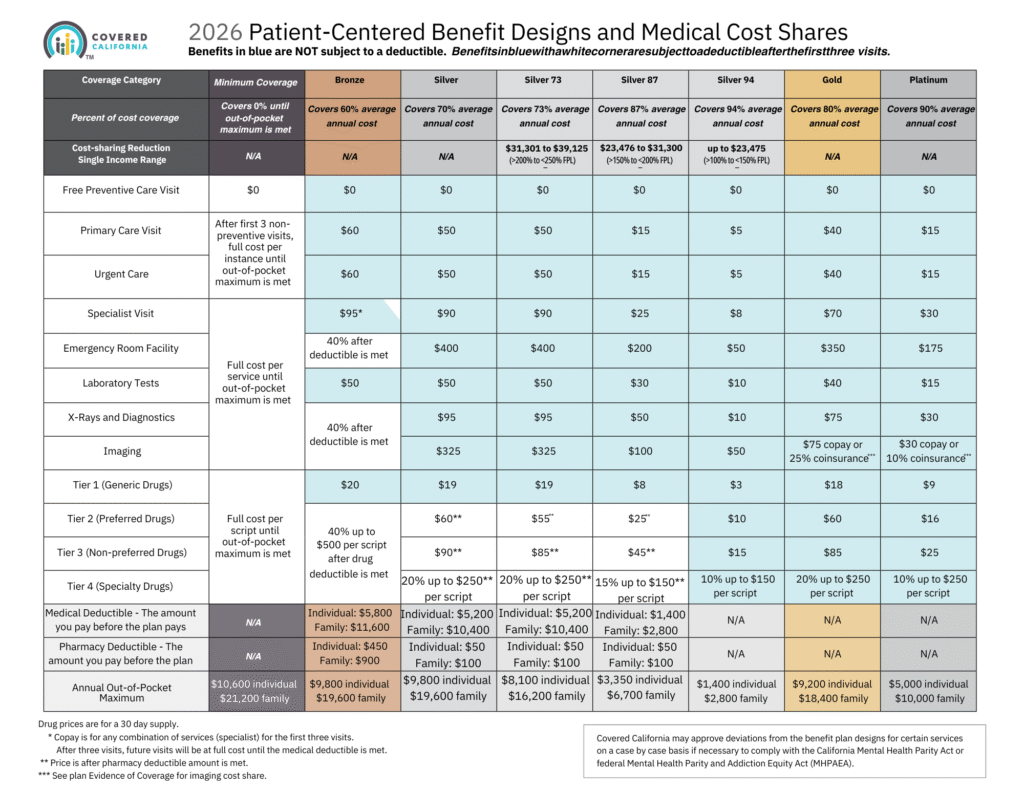

Higher Costs in 2026

Health insurance premiums and out-of-pocket costs continue to rise:

- High monthly premiums – Even with subsidies, many families pay hundreds per month

- High deductibles – You pay thousands before insurance kicks in

- High maximum out-of-pocket limits – Can reach $9,800+ for individuals, $19,600+ for families

- Limited networks – Restricted to specific doctors and hospitals

- Surprise medical bills – Even with insurance, unexpected costs add up

If you face a serious health event like cancer or a heart attack, you could still be responsible for thousands in out-of-pocket costs—even with “good” insurance.

Ready to see how we can help you reduce these costs? Talk to an expert.

Schedule Your 1-On-1 ConsultationHow We Help You Close the Gaps

We don’t just help you find a Covered California plan. We help you build a comprehensive protection package we call Umbrella that addresses the real financial exposures you face.

Solution 1: Cancer, Heart Attack & Stroke Protection

Manhattan Life Critical Illness Plan

Even with Covered California coverage, a cancer diagnosis or heart attack can devastate your finances:

What this plan does:

- Pays you cash benefits when you’re diagnosed with cancer, heart attack, or stroke

- Helps cover your maximum out-of-pocket costs

- Provides income replacement while you’re unable to work

- Covers expenses insurance doesn’t: travel, lodging, experimental treatments, home care

Why you need this:

- 1 out of 2 men and 1 out of 3 women over 50 will face cancer

- Heart disease is the #1 cause of death in America

- Your ACA plan won’t cover lost income, non-medical expenses, or help you reach your deductible faster

We recommend this coverage for every family—especially if you have a high-deductible health plan.

Want to learn more about Critical Illness Coverage?

Schedule A CallSolution 2: Affordable Choice Plan (Fixed Indemnity)

Manhattan Life Affordable Choice Plan

This is a fixed indemnity plan that pays you a set dollar amount for medical services, regardless of what your primary insurance pays. This can be used as a supplement to Covered California or as a standalone plan for those looking for an alternative option. We still recommend adding Cancer Heart Attack and Stroke plan and Dental Vision and Hearing plan to have the most comprehensive coverage.

There are a couple of ways how the Affordable Choice plan can be used:

How It Works With Covered California (Major Medical)

When paired with a major medical plan like those found on Covered California, Affordable Choice acts as a supplemental layer of protection to help bridge the major medical gap.

- Covers out-of-pocket costs: Because major medical plans often have high deductibles, you can use the fixed-dollar payouts from Affordable Choice to help pay your major medical deductible or coinsurance.

- Independent payouts: It pays its full scheduled benefit regardless of what your other insurance covers. If the plan’s payout exceeds your actual discounted bill, you can keep the surplus for other expenses.

How It Works as a Standalone Plan

As a standalone plan, it functions as a limited benefit safety net for certain types of routine care and hospitalization.

- Network discounts: You gain access to the First Health Network, which provides contractually negotiated discounts that can be as much as 40% off provider charges, depending on the provider.

- Predetermined payments: The plan pays a fixed amount “without regard to the costs of services rendered,” as listed in the policy schedule of benefits.

- Limits: It is not comprehensive insurance and includes a $5,000,000 lifetime maximum and specific calendar-year limits on outpatient benefits.

Important disclosure:

This is NOT major medical insurance and will be subject to a penalty. It is not meant to replace Covered California or ACA-compliant coverage. It’s a supplemental plan designed to help lower your out-of-pocket costs by paying fixed amounts for covered services and can act as a standalone plan.

Best for:

- Families with high-deductible Covered California plans

- Self-employed individuals looking to reduce costs

- People who need coverage but don’t qualify for subsidies

- Anyone wanting extra protection against medical bills

Your Coverage Options

First, we help you choose your foundation or base health plan. Then we add layers of protection to build your Umbrella so you’re not relying on one policy alone.

Option 1: Covered California (On-Exchange ACA Plans)

Covered California plans are ACA-compliant major medical policies that can include premium subsidies based on your household income.

- Pros: Income-based subsidies can lower your monthly premium; standardized Bronze, Silver, Gold, and Platinum tiers make comparison easier.

- Cons: High deductibles and out-of-pocket maximums; limited provider networks in many areas.

- Best for: Individuals and families who qualify for financial help and want comprehensive major medical coverage.

Option 2: Off-Exchange ACA Plans

Off-exchange plans are also ACA-compliant major medical policies, but they are purchased directly from the carrier or through a broker instead of through Covered California.

- Pros: More plan variety in some markets; in certain cases, plan design or network may fit better than on-exchange options.

- Cons: No subsidies; you pay the full premium out of pocket.

- Best for: Higher-income households who don’t qualify for subsidies but still want robust, ACA-compliant coverage.

Option 3: Affordable Choice Plan As Standalone (Fixed Indemnity – Not Major Medical)

Affordable Choice is a fixed indemnity plan from Manhattan Life that pays set dollar amounts for covered services, regardless of what a provider charges or what other insurance pays.

- What it does: Pays fixed cash benefits for doctor visits, hospital stays, surgery, and other covered services, plus access to network discounts.

- Important: This is not ACA-compliant major medical insurance and does not replace a Covered California or off-exchange plan.

- Best for: People who would otherwise go uninsured, don’t qualify for subsidies, or need a more affordable alternative and are comfortable with limited-benefit coverage.

Build Your Protection Umbrella

Once your base plan is in place (Option 1, 2, or 3), we help you add layers of protection so one health event doesn’t wreck your finances.

Umbrella A – Most Comprehensive (Recommended)

- Base Plan: Covered California or Off-Exchange ACA plan (Option 1 or 2)

- Plus: Affordable Choice fixed indemnity plan

- Plus: Cancer, Heart Attack & Stroke (Critical Illness) plan

- Plus: Dental, Vision & Hearing coverage

This package is designed to protect you from large deductibles and out-of-pocket costs, critical illness events, and routine dental/vision needs all at once.

Umbrella B – Strong Protection

- Base Plan: Covered California or Off-Exchange ACA plan (Option 1 or 2)

- Plus: Either Affordable Choice fixed indemnity or Cancer, Heart Attack & Stroke plan

- Plus: Dental, Vision & Hearing coverage

This works well if you want meaningful extra protection but need to stay within a tighter budget by choosing the most important gap to close first.

Umbrella C – Essential Upgrade

- Base Plan: Covered California or Off-Exchange ACA plan (Option 1 or 2)

- Plus: Either a Cancer, Heart Attack & Stroke plan or Dental coverage

This is a good starting point if you’re very price-sensitive but don’t want to rely solely on your ACA plan.

Umbrella D – Affordable Choice Standalone with Layers

- Base Plan: Affordable Choice standalone (Option 3 – fixed indemnity, not major medical)

- Plus: Cancer, Heart Attack & Stroke plan

- Plus: Dental, Vision & Hearing coverage

This option is for those who are not using an ACA major medical plan but still want a smart safety net instead of going completely uninsured.

How We Help

Our Simple Process:

- Compare Covered California Plans – We use the Shop and Compare tool to show you all options in your area

- Review Your Gaps – Identify where you’re exposed to high out-of-pocket costs

- Build Your Protection Package – Add Cancer/Heart/Stroke and/or Affordable Choice coverage

- Enroll & Support – We handle enrollment and provide year-round support

No Extra Fees

- You pay the same price whether you use our help or do it alone

- We’re paid by the insurance companies, not by you

- Access to multiple carriers – we’re not biased toward any one company

Ready to Explore Your Options and Build Your Umbrella?

Get a free consultation and see how we can help you build comprehensive health coverage with a personalized Umbrella that fits your budget. Click the button below.

Questions about the Affordable Choice Plan or Critical Illness coverage?

Schedule Your 1-On-1 ConsultationDo you want to self-quote for Manhattan Life? Click the button below. You’ll have the option to download the brochure for the selected plan.

Quote & Enroll: Manhattan Life

This website is owned and maintained by Franco Stella Insurance Services, Inc, which is solely responsible for its content. This site is not maintained by or affiliated with Covered California, and Covered California bears no responsibility for its content. The e-mail addresses and telephone number that appears throughout this site belong to Franco Stella Insurance Services, Inc and cannot be used to contact Covered California.